To try to get an online payday loan using PersonalLoans, finish the platform’s easy application by providing yours information, necessary loan amount, and a few monetary information. Once you’ve recorded your application, PersonalLoans often show your details using its credit people. You could found your  finance when you look at the day or fewer if the you:

finance when you look at the day or fewer if the you:

- Is 18 years old otherwise old

- Try a good U.S. citizen

- Have a legitimate Personal Safeguards amount

- Enjoys a checking account entered on your own identity

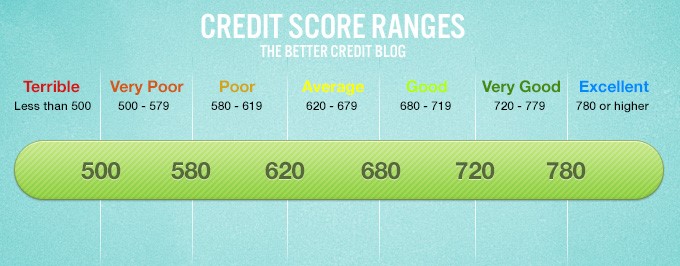

Particular individuals having reduced scores may possibly not be entitled to financing, while others may only be eligible for funds with a high ount, dependent on where you are.

Regardless, PersonalLoans has the benefit of unrivaled liberty when it comes to the amount of your payday loan. In the place of another finest payday loans systems, you can select wide variety ranging from $step 1,100000 in order to $thirty five,one hundred thousand, in addition to payment terms ranging from about three and 72 days.

Perhaps to start with, PersonalLoans prioritizes a clear, repaired loan application and you may installment system. You should understand just how much you’ve borrowed and exactly how much you’ll be able to repay, also interest rates and relevant costs. Because of this, it is possible to feel self assured on your latest and you may future economic facts.

- Minimum Loan amount: $step 1,one hundred thousand

- Restriction Loan amount: $35,one hundred thousand

- Apr Ranges: 5.99% in order to %

What exactly is a payday loan?

Cash advance is actually brief-name signature loans which you can use to have unanticipated expenses. Typically, consumers discover loan quantity anywhere between $five hundred and you will $5,100000, while some providers bring number as much as $thirty-five,100000 or maybe more.

Don’t let the fresh limited loan quantity fool your, although. Pay day loan have a tendency to incorporate high interest levels, so it is a great deal more important to pay-off the loan inside their installment months or risk including many otherwise many on the full count.

Have a tendency to, financial advisers highly recommend to avoid cash advance due to the high rates and you will charges. not, consumers that have bad credit score are not able to safe some other version of loan, making the limited cash advance loans a greatest way to get essential cash in day or smaller.

Having said that, ensure that you can also be pay-off your loan as quickly as possible to attenuate your appeal expenditures and reduce the risk of taking caught up into the an obligations stage. Communicate with an economic coach to make sure you’re making the fresh proper financial motions for your self.

Just how can Cash advance Performs?

Once you apply for a payday advance, an internet bank tend to review yours pointers, as well as your earnings and you can bank account information. After guaranteeing your own name, your payday loan lender could possibly get agree your loan request and you can finance the loan in 24 hours or less, if you meet the prerequisites.

You’ll also need certainly to offer permission for the pay day financial in order to withdraw money from your finances to settle the mortgage. In certain rare cases, you may have to upload a signed examine, and this your internet pay check lender often cash on the payment deadline. Always double-check your working with approved lenders ahead of offering a pointers.

For every pay day bank establishes its repayment due dates. Nonetheless, the due date will vary from 2 weeks to 1 times. At the conclusion of your loan term, their lender tend to withdraw the loan number, including appeal and any additional fees, from the bank account.

Knowledge Pay day loan Cost and Costs

While an online mortgage could offer a simple, effective provider getting unanticipated expenses, the new punctual payday loans started at a high price. As opposed to other signature loans, payday loan will ability rates between 391% in order to 600%.

Specific states have set caps on the pay day loan interest levels. For example, 18 says have limited interest levels so you can 36% to the that loan away from $three hundred. Nonetheless, you could spend up to 663% on an excellent $300 mortgage in states instead an interest rate roof.